Kicking off with Auto Insurance Quote Comparison: Which Company Is the Best?, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

Exploring the world of auto insurance can be overwhelming, especially when trying to figure out which company offers the best coverage at the most competitive rates. This guide aims to simplify the process by comparing different auto insurance quotes and highlighting key factors to consider before making a decision.

Introduction to Auto Insurance Quote Comparison

When it comes to auto insurance, comparing quotes from different companies is essential to finding the best coverage at the most competitive price. By taking the time to compare auto insurance quotes, individuals can make informed decisions that suit their specific needs and budget.

Benefits of Comparing Auto Insurance Quotes

- Identifying Cost-Effective Options: By comparing quotes, individuals can uncover cost-effective insurance options that provide adequate coverage for their vehicles.

- Understanding Coverage Options: Through comparison, individuals gain a better understanding of the coverage options available and can choose policies that meet their requirements.

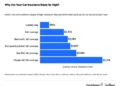

- Exploring Discounts and Savings: Auto insurance companies often offer various discounts and savings opportunities, which can only be identified through quote comparison.

Factors to Consider When Comparing Auto Insurance Quotes

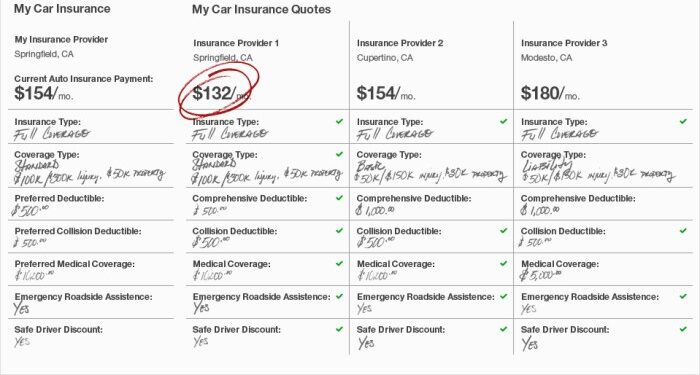

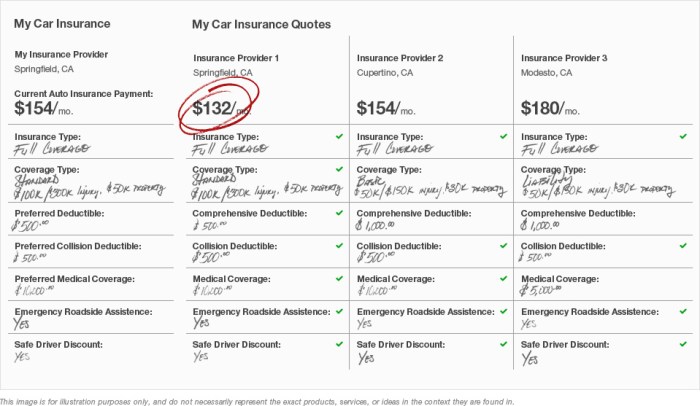

When comparing auto insurance quotes, it is crucial to consider various factors that can significantly impact the cost and coverage of your policy. From coverage options to deductibles and premiums, understanding these key factors is essential in making an informed decision about your auto insurance.

Coverage Options

- Consider the types of coverage offered by each insurance company, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Review the limits and exclusions of each coverage option to ensure they meet your specific needs and budget.

- Compare additional coverage options like roadside assistance, rental car reimbursement, and gap insurance.

Deductibles

- Understand how deductibles work and how choosing a higher or lower deductible can affect your premium.

- Higher deductibles typically result in lower premiums but require you to pay more out of pocket in the event of a claim.

- Consider your financial situation and risk tolerance when selecting a deductible amount.

Premiums

- Compare the premiums offered by different insurance companies for the same coverage options and deductibles.

- Consider any discounts or incentives that may be available to lower your premium, such as bundling policies or maintaining a clean driving record.

- Be cautious of extremely low premiums, as they may indicate inadequate coverage or poor customer service.

Discounts

- Ask about the discounts available from each insurance company, such as multi-policy, multi-car, good student, or safe driver discounts.

- Take advantage of any discounts you qualify for to reduce your overall premium costs.

Policy Details and Exclusions

- Read the fine print of each policy to understand the terms, conditions, and exclusions that may impact your coverage.

- Be aware of any limitations or restrictions on coverage, such as mileage restrictions or exclusions for certain drivers or vehicles.

- Consult with an insurance agent or representative to clarify any doubts or questions you may have about the policy details.

Best Practices for Comparing Auto Insurance Quotes

When comparing auto insurance quotes, it's crucial to follow best practices to ensure you make an informed decision. By considering these key factors, you can effectively evaluate different insurance options and choose the best one for your needs.

Step-by-Step Guide for Comparing Auto Insurance Quotes

- Start by gathering quotes: Obtain quotes from multiple insurance companies to have a range of options to compare.

- Review coverage options: Compare the coverage limits, deductibles, and types of coverage offered by each insurer.

- Consider discounts: Look into the discounts each company offers and see which ones you qualify for to potentially lower your premium.

- Check additional services: Evaluate any additional services or perks offered by the insurance companies, such as roadside assistance or rental car coverage.

- Review the final costs: Compare the total costs of each policy, including premiums, deductibles, and any additional fees.

Tips for Ensuring Accurate and Comparable Quotes

- Provide consistent information: Make sure to input the same details and coverage requirements when requesting quotes to ensure accurate comparisons.

- Ask about additional fees: Inquire about any hidden fees or charges that may not be included in the initial quote to avoid surprises later on.

- Understand the coverage terms: Familiarize yourself with insurance jargon and ask questions to clarify any terms or conditions that are unclear.

Importance of Reviewing Customer Reviews and Ratings

- Learn from others' experiences: Reading customer reviews can provide insight into the quality of service, claims process, and overall satisfaction with the insurance company.

- Consider reputation and reliability: Look for insurance companies with high ratings and positive reviews to ensure you're choosing a reputable provider.

- Compare feedback on claims handling: Pay attention to feedback on how insurance companies handle claims, as this can be a crucial factor in your decision-making process.

Top Auto Insurance Companies for Quote Comparison

When comparing auto insurance quotes, it's important to consider some of the top insurance companies known for providing competitive rates. Each company offers unique features and benefits that may appeal to different types of drivers. Let's take a closer look at some of these top auto insurance companies and compare their customer service, claims process, and overall reputation.

1. State Farm

State Farm is one of the largest auto insurance companies in the United States, known for its extensive network of agents and excellent customer service. They offer a variety of discounts for safe drivers, students, and multi-policy holders. State Farm is also recognized for its quick and efficient claims process, making it a popular choice among many drivers.

2. GEICO

GEICO is another well-known auto insurance company that is often praised for its competitive rates and user-friendly online tools. They are known for offering discounts for federal employees, military members, and good students. GEICO also has a reputation for handling claims quickly and efficiently, providing peace of mind to policyholders.

3. Progressive

Progressive is a leading auto insurance provider that offers a range of coverage options and discounts for safe drivers. They are known for their Name Your Price tool, which allows drivers to customize their coverage to fit their budget. Progressive also stands out for their innovative Snapshot program, which rewards safe driving habits with lower premiums.

4. Allstate

Allstate is a well-established auto insurance company that is known for its personalized service and variety of coverage options. They offer a wide range of discounts for safe drivers, new cars, and policy bundling. Allstate's claims process is highly rated for its efficiency and transparency, providing customers with a seamless experience in times of need.

5. USAA

USAA is a top choice for military members and their families, offering exclusive benefits and discounts tailored to their unique needs. They are known for their exceptional customer service and commitment to serving those who have served in the military.

USAA also provides a simple and straightforward claims process, making it easy for policyholders to file and track their claims.

End of Discussion

In conclusion, when it comes to choosing the best auto insurance company, thorough research and comparison are key. By understanding the factors that impact costs and coverage, individuals can make informed decisions that suit their needs and budget. Remember, the best company is not just about affordability but also about reliability and quality service.

Answers to Common Questions

What are the key factors to consider when comparing auto insurance quotes?

When comparing auto insurance quotes, it's essential to look at coverage options, deductibles, premiums, discounts, and policy details to understand the overall cost and coverage.

How can auto insurance quote comparison help individuals save money?

By comparing quotes from different companies, individuals can find the best coverage at competitive rates, potentially saving money in the long run.

What are some best practices for comparing auto insurance quotes?

Best practices include following a step-by-step guide, ensuring accuracy in quotes, and reviewing customer reviews and ratings to make an informed decision.