Delving into Auto Insurance Quote vs Estimate: What’s the Difference?, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

The content of the second paragraph that provides descriptive and clear information about the topic

Understanding Auto Insurance Quote and Estimate

When it comes to auto insurance, it's essential to understand the difference between an insurance quote and an estimate to make informed decisions. Let's dive into the definitions and distinctions between the two.

Auto Insurance Quote

An auto insurance quote is a detailed estimate provided by an insurance company outlining the cost of coverage based on the information you provide. It is a personalized offer that includes premiums, deductibles, coverage limits, and any discounts that may apply.

Auto Insurance Estimate

On the other hand, an auto insurance estimate is a rough calculation or approximation of the insurance cost based on general information. It is not as detailed or personalized as a quote and serves as a ballpark figure rather than a specific offer.

Comparison

- An insurance quote is specific, detailed, and personalized to your information, while an estimate is more general and based on average data.

- A quote provides accurate pricing and coverage details, whereas an estimate gives a rough idea of potential costs.

- You can typically obtain an insurance quote after providing detailed information, while an estimate may be given quickly with minimal details.

- Insurance quotes are binding offers that can be accepted to secure coverage, while estimates are not final and subject to change.

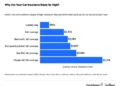

Factors Influencing Auto Insurance Quotes and Estimates

When it comes to determining the cost of auto insurance, there are several key factors that influence both insurance quotes and estimates. Understanding these factors can help you make informed decisions when shopping for auto insurance.

Factors Influencing Auto Insurance Quotes

- Your Driving Record: A clean driving record with no accidents or traffic violations will typically result in a lower insurance quote.

- Age and Gender: Younger drivers and males tend to pay higher premiums due to the higher risk associated with this demographic.

- Type of Vehicle: The make and model of your vehicle, as well as its age and safety features, can impact the cost of your insurance.

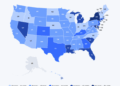

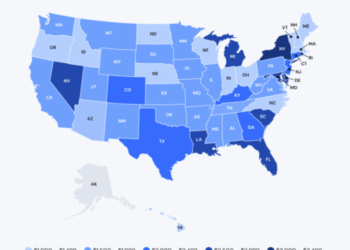

- Location: Where you live and where you park your car can affect your insurance rate, with urban areas typically having higher premiums.

- Coverage Limits: The amount of coverage you choose, including liability, collision, and comprehensive coverage, will impact your insurance quote.

Factors Influencing Auto Insurance Estimates

- Extent of Damage: When seeking an estimate for repairs after an accident, the extent of damage to your vehicle will play a significant role in determining the cost.

- Labor and Parts Costs: The cost of labor and parts needed for repairs will also influence the estimate provided by the repair shop or insurance adjuster.

- Insurance Coverage: Your insurance policy may include specific terms and conditions that could affect the estimate provided for repairs.

- Repair Shop Rates: Different repair shops may have varying labor rates, which can impact the overall estimate for repairs.

These factors showcase how auto insurance quotes focus on the risk profile of the driver and the vehicle, while estimates concentrate on the cost of repairing damages. By considering these factors, you can better understand the pricing differences between insurance quotes and estimates.

Accuracy and Reliability of Quotes and Estimates

When it comes to auto insurance, understanding the accuracy and reliability of quotes and estimates is crucial for consumers to make informed decisions. Let's delve into how these two aspects differ and what factors can influence their precision.

Accuracy of Auto Insurance Quotes vs Estimates

- Auto insurance quotes are typically more accurate than estimates as they are provided by insurance companies based on specific information provided by the consumer. These quotes are tailored to individual circumstances such as driving record, vehicle type, and coverage needs.

- On the other hand, estimates are rough calculations of potential insurance costs based on general information and assumptions. They may not take into account all the variables that could affect the final premium.

- Consumers should aim to get quotes rather than estimates to obtain a more accurate representation of their potential insurance costs.

Reliability in Predicting Actual Insurance Costs

Auto insurance quotes are more reliable in predicting actual insurance costs compared to estimates.

- Quotes are based on specific data provided by the consumer, making them a closer reflection of the final premium.

- Estimates, being more generalized, may not accurately capture all the factors that could influence the actual insurance cost.

- Consumers can rely on quotes to make more informed decisions about their insurance coverage and budgeting.

Ensuring Accuracy and Reliability

- Provide accurate information: When requesting an auto insurance quote, make sure to provide precise and up-to-date details about your driving history, vehicle, and coverage needs.

- Compare multiple quotes: To ensure accuracy and reliability, it's advisable to obtain quotes from different insurance companies and compare the coverage and costs offered.

- Ask questions: If there are discrepancies or uncertainties in the quotes received, don't hesitate to ask the insurance provider for clarification to ensure you have a complete understanding of the coverage and costs.

Obtaining Auto Insurance Quotes and Estimates

When it comes to obtaining auto insurance quotes and estimates, there are specific procedures and differences between the two processes. Let's dive into how you can request an auto insurance quote and estimate, as well as the distinctions between the two.

Requesting an Auto Insurance Quote

When you are looking to get an auto insurance quote, the process typically involves reaching out to insurance companies directly or using online tools provided by insurers. Here's how you can request an auto insurance quote:

- Provide your personal information, including your name, address, and contact details.

- Share details about your vehicle, such as make, model, year, and vehicle identification number (VIN).

- Answer questions about your driving history, including any accidents or traffic violations.

- Specify the coverage options you are interested in, such as liability, comprehensive, or collision coverage.

- Receive a personalized quote based on the information you provided.

Requesting an Auto Insurance Estimate

On the other hand, obtaining an auto insurance estimate may involve a different process compared to getting a quote. Here's how you can request an auto insurance estimate:

- Provide basic information about yourself and your vehicle.

- Give an estimate of the coverage you are looking for without providing detailed information.

- Receive a ballpark figure or a range of potential costs based on the limited information provided.

Differences in Procedures

The key difference between obtaining an auto insurance quote and estimate lies in the level of detail required. When requesting a quote, you need to provide more specific information to get an accurate price tailored to your individual circumstances. On the other hand, an estimate is more generalized and provides a rough idea of potential costs without delving into specific details.

Last Recap

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

FAQ Corner

What is the difference between an auto insurance quote and an estimate?

An auto insurance quote is a precise offer given by an insurance company, while an estimate is a rough calculation of the potential cost.

How do factors influence auto insurance quotes and estimates differently?

Factors like driving record, location, and vehicle type affect quotes, while estimates are based on general information and may not be as personalized.

Which is more accurate, auto insurance quotes or estimates?

Auto insurance quotes are usually more accurate as they are specific, while estimates can vary widely and may not reflect the final cost.