Exploring the realm of Average Auto Insurance Quote by State in 2025, this introduction aims to provide a detailed insight into the factors affecting insurance costs, state-wise variations, and future trends. With a mix of informative content and engaging language, readers are set to embark on a journey of understanding the dynamics of auto insurance quotes.

In the subsequent paragraphs, we will delve deeper into the intricacies of auto insurance quotes, shedding light on the key factors influencing costs and the significance of these variations across different states.

Overview of Auto Insurance Quotes in 2025

Auto insurance quotes play a crucial role in determining the cost of insuring a vehicle. These quotes are estimates provided by insurance companies based on various factors that influence the overall premium amount. Understanding the nuances of auto insurance quotes can help individuals make informed decisions when selecting the right coverage for their vehicles.

Factors Influencing Average Auto Insurance Quotes

Several factors impact the average auto insurance quote in different states. These factors can vary significantly and contribute to the differences in insurance costs across state lines.

- State Regulations: Each state has its own set of regulations and requirements for auto insurance coverage, which can influence the overall cost of insurance.

- Population Density: States with higher population density tend to have more traffic congestion and a higher likelihood of accidents, leading to increased insurance rates.

- Weather Conditions: States prone to extreme weather conditions, such as hurricanes or snowstorms, may have higher insurance rates due to the increased risk of vehicle damage.

- Crime Rates: Areas with higher crime rates may experience more incidents of vehicle theft or vandalism, impacting insurance premiums.

Importance of Understanding Variations in Auto Insurance Costs

It is essential to grasp the variations in auto insurance costs by state to make informed decisions about coverage options and budgeting. By understanding the factors that influence insurance rates in a particular state, individuals can tailor their coverage to meet their needs while staying within their budget.

Factors Affecting Auto Insurance Quotes

When it comes to determining auto insurance quotes, several key factors play a significant role in influencing the cost. These factors can vary from state to state based on regulations, laws, and individual circumstances.

State-Specific Regulations and Laws

State-specific regulations and laws can have a direct impact on auto insurance costs. For example, some states may require higher minimum coverage limits, leading to higher premiums. Additionally, states with a higher frequency of accidents or a greater number of uninsured drivers may also see increased insurance rates.

Personal Factors

Personal factors such as age, driving history, and vehicle type can also affect insurance quotes. Younger drivers or those with a history of accidents or traffic violations may face higher premiums due to an increased risk factor. Moreover, the make and model of the vehicle can impact insurance costs, with luxury or sports cars typically carrying higher rates than more practical models.

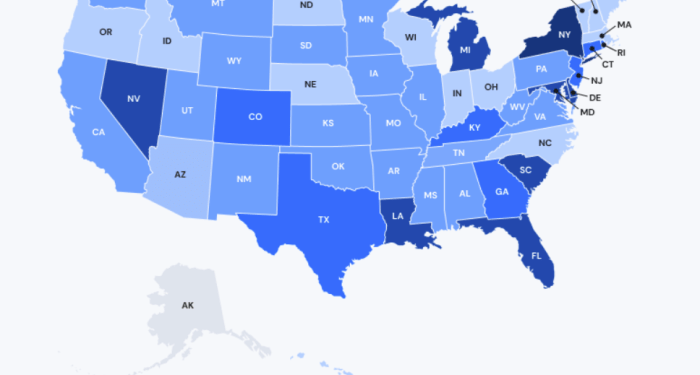

Comparison of Average Quotes Across States

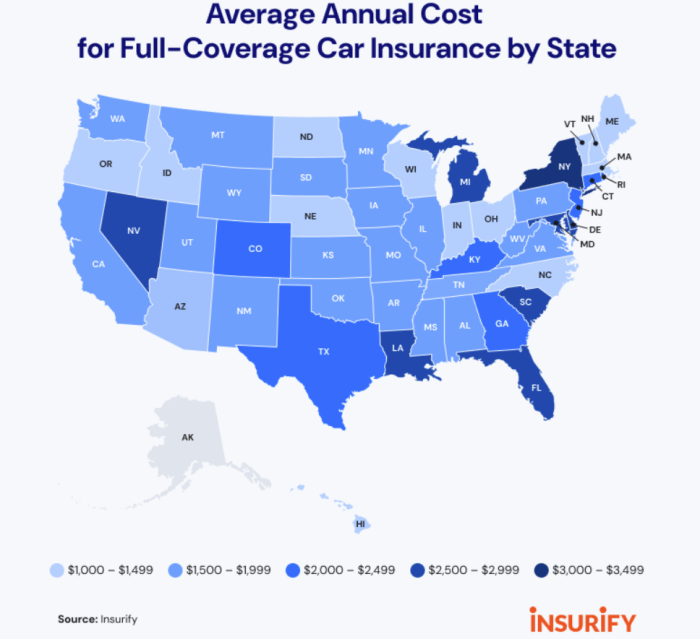

In 2025, the average auto insurance quotes vary significantly across different states in the US. These variations can be attributed to a variety of factors such as population density, traffic conditions, crime rates, weather patterns, and state insurance regulations.

States with the Highest Average Auto Insurance Quotes

- Michigan: Michigan has consistently been one of the states with the highest auto insurance rates due to its no-fault insurance system and high incidence of insurance fraud.

- Louisiana: Louisiana also ranks among the states with the highest auto insurance premiums, partly due to a high number of uninsured drivers and frequent natural disasters.

- Florida: Florida's unique insurance laws, such as the requirement for personal injury protection (PIP) coverage, contribute to its higher-than-average insurance costs.

States with the Lowest Average Auto Insurance Quotes

- Vermont: Vermont is known for having some of the lowest auto insurance rates in the country, likely due to its rural nature and lower population density.

- Ohio: Ohio also tends to have relatively affordable auto insurance premiums compared to other states, thanks to its competitive insurance market and lower incidence of accidents.

- Maine: Maine rounds out the list of states with lower average auto insurance quotes, possibly due to its smaller population and fewer urban areas.

| State | Average Auto Insurance Quote |

|---|---|

| Michigan | $2,600 |

| Louisiana | $2,400 |

| Florida | $2,300 |

| Vermont | $900 |

| Ohio | $1,000 |

| Maine | $950 |

Trends and Predictions for 2025

In the year 2025, we can expect to see several trends and predictions in the auto insurance industry that could impact insurance costs and state-wise quotes.

Impact of Advancements in Technology

- With the rise of autonomous vehicles and advanced safety features, such as collision avoidance systems and self-parking capabilities, insurance companies may need to adjust their pricing models.

- As these technologies become more widespread, there could be a shift towards usage-based insurance where premiums are based on individual driving behavior and the level of automation in the vehicle.

- Insurance companies may also need to account for cybersecurity risks associated with connected cars, leading to potential changes in coverage and pricing.

Changes in Driving Habits

- The increase in remote work and telecommuting could result in fewer miles driven, leading to potential discounts for low-mileage drivers.

- On the other hand, the popularity of ride-sharing services and delivery apps could lead to higher insurance costs for commercial drivers and vehicles used for business purposes.

- Additionally, the shift towards electric vehicles may also impact insurance pricing, as repair and replacement costs for EVs are often higher than traditional vehicles.

Industry Shifts Affecting State-wise Quotes

- Changes in regulations, such as new laws on distracted driving or insurance requirements for emerging technologies, could vary by state and influence insurance costs accordingly.

- The consolidation of insurance companies, changes in underwriting practices, and the introduction of new competitors like InsurTech startups could also impact state-wise quotes in 2025.

- Climate-related events, such as severe weather patterns and natural disasters, may lead to localized spikes in insurance premiums in states prone to these risks.

Final Wrap-Up

As we conclude our discussion on Average Auto Insurance Quote by State in 2025, we reflect on the diverse landscape of insurance costs, the impact of personal and state-specific factors, and the evolving trends that may shape the future of auto insurance.

Through this exploration, readers are equipped with a comprehensive understanding of the complexities surrounding auto insurance quotes in 2025.

Q&A

What are some key factors influencing auto insurance costs?

Factors such as age, driving history, vehicle type, and state-specific regulations play a significant role in determining auto insurance quotes.

Which states are likely to have the highest and lowest average auto insurance quotes in 2025?

States with denser populations and higher rates of accidents tend to have higher average insurance quotes, while states with lower population density and fewer accidents may have lower quotes.

How do advancements in technology impact insurance costs?

Technological advancements like telematics and self-driving cars can potentially lower insurance costs by reducing accidents and improving overall driver safety.