Exploring the intricate relationship between age, location, and auto insurance quotes sheds light on how these factors can significantly influence the cost of your coverage. By understanding the nuances of how age and location impact insurance premiums, you can make informed decisions to optimize your insurance rates and coverage.

Delving deeper into the specifics of how age and location intersect with auto insurance quotes provides valuable insights that can empower you to navigate the insurance landscape more effectively.

Factors influencing auto insurance rates

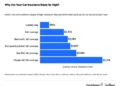

Age and location play a crucial role in determining auto insurance premiums. Insurance companies use these factors to assess the level of risk associated with insuring a driver and setting the appropriate rates. Let's explore how age and location impact insurance costs differently and compare their effects on auto insurance quotes.

Age impact on auto insurance rates

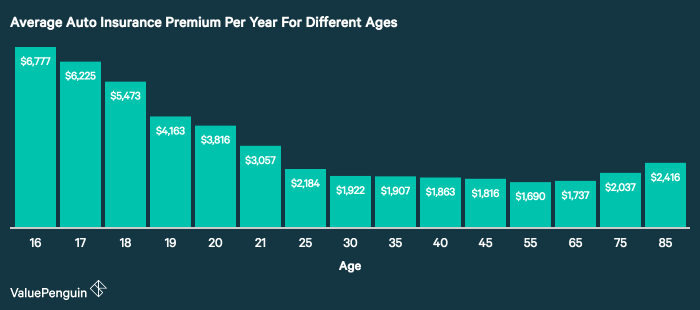

Age is a significant factor that affects auto insurance rates. Younger drivers, especially teenagers, are considered high-risk due to their lack of driving experience and tendency for risky behaviors. As a result, insurance premiums for young drivers are often higher to account for the increased likelihood of accidents and claims.

On the other hand, older drivers, particularly those above 25 or 30 years old, may benefit from lower insurance rates as they are seen as more experienced and responsible behind the wheel.

Location impact on auto insurance rates

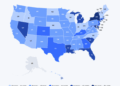

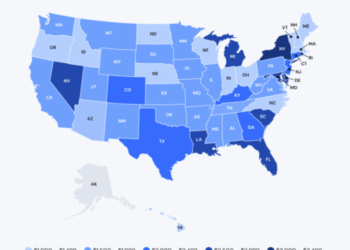

Location is another key factor that influences auto insurance quotes. Urban areas with high population density tend to have more traffic congestion, higher rates of accidents, and increased instances of theft and vandalism. As a result, drivers in urban areas may face higher insurance premiums compared to those in rural areas.

Additionally, factors such as weather conditions, crime rates, and the quality of local infrastructure can also impact insurance costs based on the location of the driver.

Comparison of age vs. location impact on auto insurance costs

While both age and location play a significant role in determining auto insurance rates, the impact of age may vary more significantly than location. Younger drivers typically face much higher insurance premiums compared to older, more experienced drivers, regardless of their location.

On the other hand, the difference in insurance costs between urban and rural areas may be significant but can also depend on other individual factors such as driving record, vehicle type, and coverage options.

Age-related factors affecting auto insurance quotes

Age plays a significant role in determining auto insurance premiums, as it is closely linked to factors that impact risk assessment by insurance companies.Experience, maturity, and accident rates vary with age. Younger drivers, typically under the age of 25, are considered less experienced and more prone to accidents due to their limited time behind the wheel.

On the other hand, older drivers, especially those above 65, may face challenges related to declining vision, reaction time, and overall physical abilities, which can increase the likelihood of accidents.Insurance companies assess risk based on different age groups by analyzing historical data on claims and accidents.

They use this information to determine the likelihood of a driver filing a claim and adjust premiums accordingly. Younger drivers are often charged higher premiums due to their higher risk profile, while older drivers may also face increased rates based on statistical data related to their age group

For example, some companies offer discounts to mature drivers with a clean driving record, while others may impose surcharges on younger drivers with a history of accidents or traffic violations. These adjustments aim to align premiums with the expected cost of insuring drivers in different age brackets.

Location-based factors influencing auto insurance rates

When it comes to determining auto insurance rates, the location where you live plays a significant role. Various factors related to your location can impact the cost of your premiums.

Urban vs. Rural Locations

Living in an urban area typically results in higher insurance rates compared to rural locations. Urban areas tend to have higher population density, which can lead to more accidents and theft, thus increasing the risk for insurance companies.

Impact of Crime Rates and Traffic Congestion

Areas with high crime rates are considered riskier by insurance companies, leading to higher premiums. Similarly, locations with heavy traffic congestion can increase the likelihood of accidents, impacting insurance costs.

Weather Patterns and Natural Disasters

Regions prone to severe weather patterns or natural disasters, such as hurricanes, tornadoes, or earthquakes, can also affect insurance quotes. Insurance companies factor in the risk of damage due to these events when calculating premiums.

Closing Notes

In conclusion, the interplay of age and location in the realm of auto insurance quotes is a multifaceted phenomenon that warrants careful consideration. By recognizing the impact of these variables on insurance costs, you can proactively manage your coverage to achieve optimal outcomes tailored to your unique circumstances.

Essential FAQs

How does age affect auto insurance quotes?

Age plays a significant role in determining auto insurance rates. Younger drivers typically face higher premiums due to their perceived higher risk of accidents.

What impact does location have on auto insurance costs?

Location influences insurance costs based on factors like crime rates, traffic congestion, and weather patterns. Urban areas tend to have higher premiums compared to rural areas.

Are there specific discounts for different age groups?

Insurance companies often offer age-related discounts for mature drivers or surcharges for younger drivers. These discounts are based on statistical risk assessments.