Delving into the realm of credit scores and auto insurance quotes, this initial passage sets the stage for an enlightening exploration that promises valuable insights and practical knowledge.

The following paragraph will shed light on the intricate relationship between credit scores and insurance premiums.

How Credit Score Affects Auto Insurance Quotes

Having a good credit score can significantly impact the auto insurance quotes you receive. Insurance companies use your credit score as a factor in determining your premiums, with lower scores often resulting in higher costs.

Relationship Between Credit Score and Auto Insurance Premiums

Your credit score reflects your financial responsibility and risk level, which insurers use to predict the likelihood of you filing a claim. A higher credit score indicates a lower risk of filing a claim, leading to lower premiums. On the other hand, a lower credit score suggests a higher risk and can result in higher insurance costs.

Examples of Impact of Credit Score on Insurance Costs

- Example 1: A driver with an excellent credit score may receive quotes that are significantly lower compared to a driver with a poor credit score, even if all other factors are similar.

- Example 2: Studies have shown that drivers with poor credit scores can pay up to twice as much for auto insurance compared to those with excellent credit scores.

Reasons for Considering Credit Scores in Insurance Quotes

Insurance companies use credit scores as one of many factors to assess risk and set premiums. They believe that individuals with higher credit scores are more likely to make timely payments, be responsible, and therefore file fewer claims. This correlation between credit score and insurance risk drives the decision to include credit scores in determining quotes.

Factors Considered in Credit Score Impact

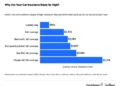

When it comes to determining auto insurance rates, several factors are taken into consideration, with credit score being just one of them. Other important factors that can influence your insurance premiums include:

Driving History

- Your driving record plays a significant role in determining your auto insurance rates. A history of accidents, traffic violations, or DUIs can result in higher premiums.

- Drivers with a clean record are often rewarded with lower insurance rates as they are considered less risky to insure.

Age

- Younger drivers, especially teenagers, typically face higher insurance premiums due to their lack of driving experience and higher likelihood of being involved in accidents.

- As drivers age and gain more experience on the road, their insurance rates may decrease.

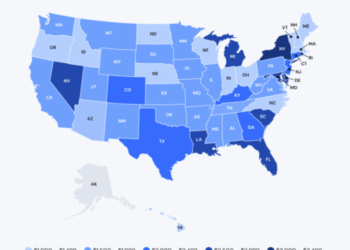

Location

- Where you live can also impact your auto insurance rates. Urban areas with higher rates of traffic congestion and vehicle theft may result in higher premiums.

- Rural areas, on the other hand, may have lower insurance rates due to lower instances of accidents and theft.

Credit Inquiries and Debt Levels

- Multiple credit inquiries or a high level of debt can negatively impact your credit score, which in turn can lead to higher insurance premiums.

- Insurance companies may view individuals with a history of financial instability as higher risk and therefore charge them more for coverage.

Ways to Improve Credit Score for Better Insurance Rates

Improving your credit score can have a significant impact on the auto insurance rates you are offered. By taking proactive steps to boost your credit score, you can potentially lower your insurance costs over time.

Timely Bill Payments

One of the most effective ways to improve your credit score is by making timely bill payments. Late payments can have a negative impact on your credit score, so it's important to pay your bills on time each month.

Credit Utilization

Another factor that can influence your credit score is credit utilization. This refers to the amount of credit you are using compared to the total amount of credit available to you. Keeping your credit utilization low can help improve your credit score.

Credit Monitoring

Regularly monitoring your credit report can also help you identify any errors or discrepancies that could be negatively impacting your credit score. By staying on top of your credit report, you can take steps to correct any mistakes and improve your overall creditworthiness.

Long-Term Benefits of Good Credit Score

Maintaining a good credit score can have long-term benefits when it comes to auto insurance. A higher credit score can lead to lower insurance premiums, saving you money in the long run. Additionally, a good credit score can also make you a more attractive candidate for other types of loans and financial opportunities.

Legal Aspects and Regulations

When it comes to the use of credit scores in determining insurance rates, there are legal regulations in place to ensure fairness and transparency in the process. These regulations aim to protect consumers and prevent discrimination based on credit history.

Regulations on Credit Score Impact

- In the United States, most states allow insurance companies to consider credit scores when calculating auto insurance rates. However, some states have restrictions on how much weight can be given to credit scores.

- The Fair Credit Reporting Act (FCRA) regulates how credit information can be used by insurance companies. It requires insurers to provide a valid reason for using credit scores to determine rates and allows consumers to dispute any inaccuracies in their credit reports.

Consumer Protections

- Consumers are entitled to receive a copy of their credit report for free once a year from each of the major credit reporting agencies. This allows them to monitor their credit history and address any issues that may impact their insurance rates.

- If a consumer's credit score has been negatively affected by extenuating circumstances, such as a medical emergency or natural disaster, they may request that the insurance company take these factors into consideration when setting rates.

State Variations

- Each state has its own regulations regarding the use of credit scores in insurance. Some states, like California, Hawaii, and Massachusetts, have banned the use of credit scores in setting insurance rates, while others have specific guidelines on how credit information can be used.

- It's important for consumers to be aware of the regulations in their state and understand how credit scores may impact their auto insurance rates.

Ending Remarks

Wrapping up our discussion, this final paragraph encapsulates the key takeaways and leaves a lasting impression on the significance of credit scores in the realm of auto insurance quotes.

General Inquiries

How does a good credit score affect auto insurance costs?

A good credit score can lead to lower insurance costs as insurance companies view individuals with good credit as less risky to insure, resulting in potential discounts.

What factors, aside from credit score, can influence auto insurance rates?

Factors like driving history, age, and location also play a significant role in determining auto insurance rates, alongside credit score.

Are there legal regulations regarding the use of credit scores in insurance rates?

Yes, there are regulations in place to govern how insurance companies can use credit scores when calculating insurance rates to ensure fairness and consumer protection.