Exploring the correlation between credit scores and auto insurance quotes opens up a world of insights. As we delve into this topic, we unravel how your credit score can significantly influence the rates you pay for auto insurance.

Let's navigate through the intricate details of how credit scores play a crucial role in shaping your auto insurance premiums.

How Credit Score Affects Auto Insurance Quotes

When it comes to determining auto insurance premiums, credit scores play a significant role. Insurers often use credit-based insurance scores to assess the risk associated with a potential policyholder.

Good Credit Score and Lower Insurance Costs

Having a good credit score can lead to lower auto insurance costs. Insurers view individuals with higher credit scores as more financially responsible and less likely to file insurance claims. As a result, they are considered lower risk and eligible for lower premiums.

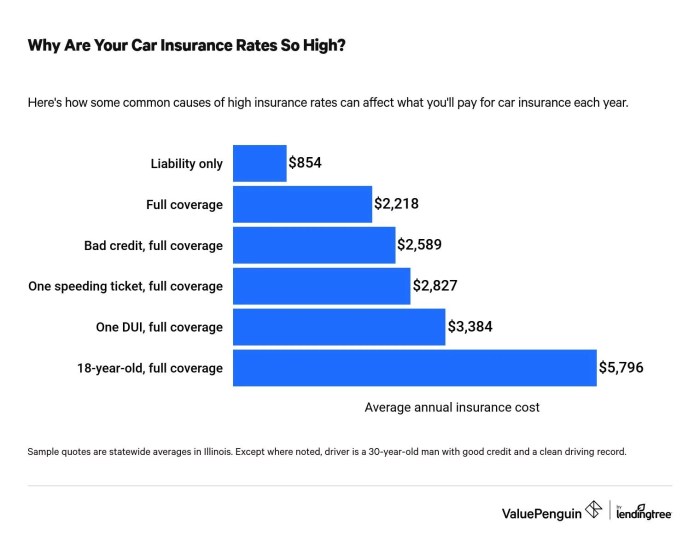

Impact of Poor Credit Score on Auto Insurance Rates

Conversely, a poor credit score can result in higher auto insurance rates. Insurers may see individuals with lower credit scores as higher risk and more likely to file claims, leading to increased premiums to offset this perceived risk.

Factors Considered by Insurers

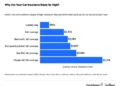

When determining auto insurance quotes, insurers take into account a variety of factors beyond just credit score. These factors help insurers assess the level of risk associated with insuring an individual and ultimately determine the premium they will pay.

Driving Record

- A clean driving record, free of accidents and traffic violations, is typically rewarded with lower insurance premiums.

- On the other hand, a history of accidents or traffic violations can lead to higher premiums as it indicates a higher risk of future claims.

Age

- Youthful drivers are often charged higher premiums due to their lack of experience and statistically higher likelihood of being involved in accidents.

- Older, more experienced drivers may benefit from lower premiums as they are considered less risky to insure.

Location

- The location where you live can significantly impact your insurance premium.

- Urban areas with higher rates of accidents and theft may result in higher premiums compared to rural areas with lower risk factors.

Credit-Based Insurance Scores

Insurers use credit-based insurance scores, which are based on credit history and other financial information, to help predict the likelihood of a policyholder filing a claim. These scores are different from traditional credit scores and are specifically designed for insurance purposes.

Insurers assign different weightage to each factor when calculating auto insurance quotes. While credit score is an important factor, driving record, age, and location also play significant roles in determining premiums.

Ways to Improve Credit Score for Better Rates

Improving your credit score can have a significant impact on the auto insurance rates you are offered. By demonstrating responsible financial habits, you can show insurers that you are a lower risk driver, leading to lower premiums. Here are some tips to help you improve your credit score and secure better rates on your auto insurance

Pay Your Bills on Time

- Make sure to pay all your bills on time, including credit card payments, loan payments, and utility bills. Late payments can negatively impact your credit score.

- Set up automatic payments or reminders to ensure you never miss a payment deadline.

Reduce Your Debt

- Try to pay down your existing debt as much as possible. High levels of debt relative to your credit limits can harm your credit score.

- Avoid maxing out your credit cards and aim to keep your credit utilization ratio below 30%.

Check Your Credit Report Regularly

- Monitor your credit report for any errors or inaccuracies that could be dragging down your score. Dispute any mistakes you find with the credit bureaus.

- Regularly reviewing your credit report can also help you identify areas for improvement and track your progress over time.

Limit New Credit Applications

- Applying for multiple new lines of credit within a short period can signal financial instability to lenders and lower your credit score.

- Be strategic about when and why you apply for new credit to minimize the impact on your credit score.

Legal Aspects and Regulations

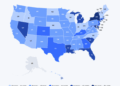

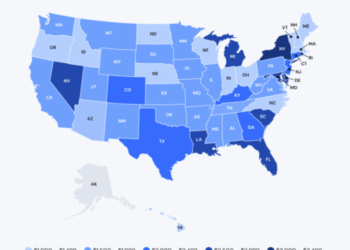

In the United States, the use of credit scores in setting auto insurance rates is a subject of debate and regulation. While most states allow insurers to consider credit scores as a factor in determining insurance premiums, some states have restrictions or outright prohibitions on this practice.

States with Restrictions on Credit Scores for Insurance

- California: Prohibits the use of credit scores in setting auto insurance rates.

- Massachusetts: Limits the impact of credit scores on insurance premiums.

- Hawaii: Also restricts the use of credit scores in determining insurance rates.

Proposed Legislation and Changes

There have been ongoing discussions at the federal level regarding the use of credit scores in insurance pricing. Some lawmakers argue that it can lead to unfair discrimination, especially for low-income individuals.

- Proposed changes include stricter regulations on how credit scores can be used in setting insurance rates.

- Advocates for reform argue for more transparency and accountability in the process.

Final Wrap-Up

In conclusion, understanding how your credit score impacts your auto insurance quote is key to making informed decisions. By grasping this relationship, you can take proactive steps to potentially lower your insurance costs.

Essential FAQs

How does a good credit score affect auto insurance costs?

A good credit score can lead to lower insurance costs as insurers view individuals with good credit as less risky to insure.

What factors, besides credit score, influence auto insurance quotes?

Other factors include driving record, age, location, and the type of vehicle being insured.

How can one improve their credit score for better insurance rates?

Improving credit score involves practicing responsible financial habits, such as paying bills on time and reducing debt.

Are there any legal restrictions on using credit scores for insurance pricing?

Some states have restrictions on using credit scores for setting insurance rates, and there are ongoing discussions about potential changes in legislation.