Exploring the realm of obtaining precise auto insurance quotes online in 2025, this introduction sets the stage for a deep dive into the intricacies of the process. It promises an enlightening journey filled with essential insights and valuable information for readers seeking clarity in the world of insurance.

In the subsequent paragraphs, readers will find detailed explanations and analysis on the key aspects related to acquiring accurate auto insurance quotes online in the futuristic landscape of 2025.

Understanding the Importance of Accurate Auto Insurance Quotes

Having an accurate auto insurance quote is crucial for consumers as it directly impacts their financial well-being and coverage in case of accidents or damages. An inaccurate quote can lead to unexpected costs, inadequate coverage, or even policy cancellations.

Identifying Consequences of Inaccurate Quotes

When policyholders receive inaccurate auto insurance quotes, they may face several consequences:

- Underestimation of Premiums: Inaccurate quotes may result in policyholders paying lower premiums initially, only to be faced with higher costs later on.

- Inadequate Coverage: Incorrect information provided during the quoting process can lead to insufficient coverage for damages or liabilities.

- Policy Cancellations: If discrepancies are found between the quote and the actual information, insurers may cancel the policy, leaving the policyholder uninsured.

Advancements in Technology Impacting Quote Accuracy in 2025

With advancements in technology, the accuracy of auto insurance quotes in 2025 is expected to improve significantly:

- AI and Machine Learning: Insurers are utilizing AI algorithms and machine learning to analyze vast amounts of data and provide more accurate quotes based on individual risk factors.

- Telematics and IoT Devices: The use of telematics devices and IoT technology allows insurers to gather real-time data on driving behavior, enabling personalized and precise quotes.

- Digital Platforms: Online platforms and mobile apps streamline the quoting process, reducing human error and ensuring that the information provided is accurate.

Factors Influencing Auto Insurance Quotes in 2025

In 2025, several factors will continue to influence auto insurance quotes, combining traditional elements with new emerging trends. Personal data and technological advancements will play a crucial role in determining these quotes, impacting the pricing and coverage options offered to consumers.

Traditional Factors vs. New Factors

- Traditional Factors:

- Driving History: Your past driving record, including accidents and traffic violations, has always been a key factor in determining auto insurance quotes.

- Vehicle Type: The make and model of your vehicle, as well as its age and condition, have traditionally influenced insurance premiums.

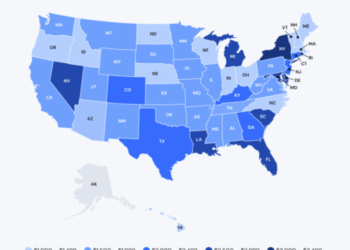

- Location: Where you live and where you primarily drive can impact your rates due to factors like crime rates, traffic congestion, and weather conditions.

- Credit Score: In many regions, credit history has been used to assess risk and determine insurance costs.

- New Factors in 2025:

- Telematics Data: The use of telematics devices to track driving behavior, such as speed, braking patterns, and mileage, allows for personalized premiums based on individual driving habits.

- Smart Technology Integration: Increasingly, vehicles are equipped with advanced safety features and connectivity, influencing insurance rates based on the level of technology present.

- Environmental Impact: With a growing focus on sustainability, eco-friendly vehicles may receive discounts or special rates based on their environmental impact.

- Data Analytics: Insurers are utilizing big data and analytics to assess risk more accurately, leading to personalized quotes based on a wider range of data points.

Personal Data and Technology Advancements

In 2025, personal data obtained through various sources, including social media, online activity, and IoT devices, will be used to assess risk and determine auto insurance quotes. By analyzing this data, insurers can tailor coverage options and pricing to individual policyholders.

Technological advancements such as artificial intelligence and machine learning algorithms will enable more precise risk assessment and predictive modeling, resulting in quotes that are more reflective of the actual risk profile of the insured individual.

Utilizing Online Tools for Accurate Quotes

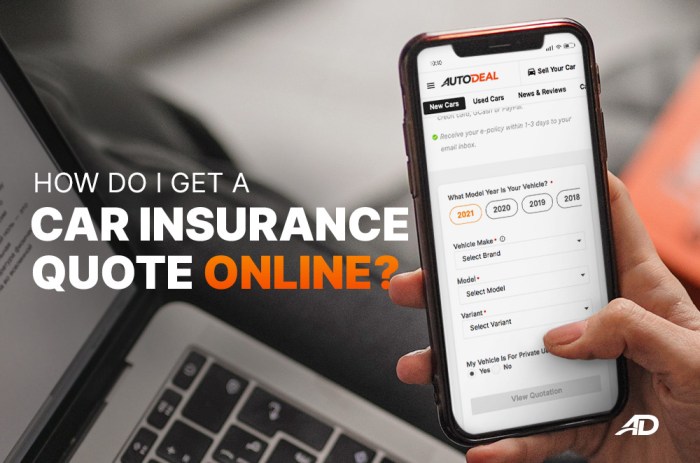

When it comes to obtaining accurate auto insurance quotes efficiently, online tools can be a game-changer

Step-by-Step Guide to Using Online Tools

- Start by visiting a reputable auto insurance comparison website or the official website of an insurance provider.

- Enter your personal information, including your name, address, vehicle details, driving history, and coverage preferences.

- Ensure all information is accurate and up-to-date to receive the most precise quotes.

- Review the quotes provided by different insurance companies and compare coverage options and premiums.

- Select the quote that best fits your needs and budget, and proceed to purchase the policy online or contact the insurance company directly for further assistance.

Benefits of Using Online Platforms

- Time-Saving: Online tools provide instant quotes, eliminating the need for lengthy phone calls or in-person visits to insurance agencies.

- Convenience: You can access online tools 24/7 from the comfort of your home or anywhere with an internet connection.

- Transparency: Online platforms allow you to compare multiple quotes side by side, enabling informed decision-making.

- Cost-Effective: By comparing quotes online, you can find competitive rates and potentially save money on your auto insurance premiums.

Accuracy of Online Quotes vs. Traditional Methods

Online tools have revolutionized the way auto insurance quotes are obtained, offering greater accuracy compared to traditional methods. By providing real-time data and personalized quotes based on the information you input, online platforms ensure that you receive tailored quotes that reflect your unique circumstances.

In contrast, traditional methods such as phone calls or in-person visits may be prone to human error or outdated information, leading to less precise quotes.

Ensuring Data Privacy and Security

When obtaining auto insurance quotes online, it is crucial to prioritize data privacy and security. Providing personal information in exchange for quotes can expose individuals to potential risks if not properly safeguarded.

Importance of Data Privacy

- Insurance quotes require sensitive personal information such as driving history, address, and vehicle details.

- Unauthorized access to this data can lead to identity theft, fraud, or misuse of personal information.

- Protecting data privacy ensures that individuals are not vulnerable to cyber-attacks or scams.

Potential Risks of Sharing Personal Data

- Third-party data breaches can compromise the confidentiality of personal information provided for insurance quotes.

- Shared data may be used for targeted advertising or sold to other companies without consent.

- Inaccurate quotes may result if data is manipulated or misused by unauthorized parties.

Ensuring Data Security by Insurance Companies

- Implementing encryption protocols to protect data transmission between users and insurance websites.

- Regular security audits and updates to safeguard against evolving cyber threats.

- Obtaining consent for data usage and ensuring compliance with data protection regulations.

Closing Notes

Concluding our discussion on obtaining accurate auto insurance quotes online in 2025, this final section encapsulates the main points covered and leaves readers with a comprehensive understanding of the topic. It reinforces the significance of staying informed and leveraging technology for a seamless insurance experience in the years to come.

Detailed FAQs

Why is it important to have an accurate auto insurance quote?

Having an accurate quote ensures that consumers make informed decisions about their insurance coverage and costs, avoiding any surprises or underestimations in the future.

What are the risks of inaccurate quotes for policyholders?

Policyholders might end up with insufficient coverage or pay more than necessary if quotes are inaccurate, leading to financial burdens and potential legal issues.

How can insurance companies ensure data privacy and security when collecting information online?

Insurance companies can implement encryption protocols, secure servers, and strict data handling policies to protect consumers' personal information from cyber threats and breaches.