Starting with the topic of How to Save Money on Your Auto Insurance Quote Every Year, this guide aims to provide valuable insights and strategies to help you make informed decisions and potentially reduce your auto insurance costs.

Exploring the various factors, coverage options, discounts, and shopping strategies, this guide will equip you with the knowledge needed to navigate the complex world of auto insurance with confidence.

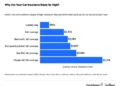

Factors Affecting Auto Insurance Rates

When it comes to determining auto insurance rates, several factors come into play. Factors such as age, location, driving history, and the type of vehicle you drive can all impact how much you pay for coverage.

Age

Age is a significant factor in determining auto insurance rates. Younger drivers, especially teenagers, are considered higher risk due to their lack of experience on the road. As a result, they often face higher premiums compared to older, more experienced drivers.

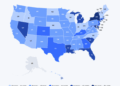

Location

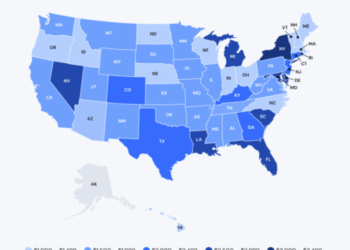

Where you live also plays a role in your auto insurance rates. Urban areas with higher population densities and higher rates of accidents or thefts may result in higher premiums compared to rural areas with lower risks.

Driving History

Your driving history, including past accidents, traffic violations, and claims, can impact your auto insurance rates. A clean driving record with no accidents or tickets can lead to lower premiums, while a history of accidents or violations may result in higher costs.

Type of Vehicle

The type of vehicle you drive can also affect your insurance rates. Expensive or high-performance cars may cost more to insure due to the cost of repairs or the likelihood of theft. On the other hand, safe and reliable vehicles may qualify for lower premiums.By understanding how these factors influence auto insurance rates, you can take steps to potentially lower your premiums.

Maintaining a clean driving record, choosing a safe vehicle, and comparing quotes from different providers are all strategies that can help you save money on your auto insurance every year.

Types of Coverage Options

When it comes to auto insurance, there are various coverage options available to protect you and your vehicle in different situations. Understanding the types of coverage options and choosing the right ones based on your individual needs and budget is crucial for a well-rounded insurance policy.

Comprehensive Coverage

Comprehensive coverage helps cover damages to your vehicle that are not caused by a collision, such as theft, vandalism, natural disasters, or hitting an animal. It provides protection for a wide range of non-collision incidents.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if it is damaged in a collision with another vehicle or object. This coverage is especially important if you have a newer or more expensive car.

Liability Coverage

Liability coverage helps cover the costs if you are found at fault in an accident that causes damage to another person's property or injuries to other people. It is required by law in most states and is essential for protecting your assets in case of a lawsuit.

Uninsured/Underinsured Motorist Coverage

This coverage helps protect you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. It can also help with medical expenses if you are hit by a hit-and-run driver.

Personal Injury Protection (PIP) Coverage

PIP coverage helps cover medical expenses for you and your passengers in case of an accident, regardless of who is at fault. It can also help with lost wages and other expenses related to the accident.

Choosing the Right Coverage Options

When selecting coverage options for your auto insurance policy, consider factors such as the value of your vehicle, your driving habits, and your budget. It's essential to strike a balance between adequate coverage and affordability to ensure you are protected without overpaying for insurance you may not need.

Discounts and Savings Opportunities

When it comes to saving money on your auto insurance, taking advantage of discounts and savings opportunities can significantly reduce your premium costs. Let's explore some common ways you can save on your auto insurance.

Bundling Policies

One of the most popular ways to save on auto insurance is by bundling multiple policies with the same insurance company. This could include combining your auto insurance with your homeowner's or renter's insurance. By bundling your policies, you can often qualify for a discount on each policy, ultimately saving you money in the long run.

Maintaining a Good Driving Record

Another key factor that can lead to savings on your auto insurance is maintaining a good driving record. Insurance companies typically offer discounts to drivers who have a clean driving history with no accidents or traffic violations. By practicing safe driving habits and avoiding incidents on the road, you can qualify for lower insurance premiums.

Other Savings Opportunities

- Consider taking a defensive driving course to qualify for additional discounts.

- Ask your insurance company about discounts for safety features in your vehicle, such as anti-theft devices or airbags.

- Explore options for low mileage discounts if you don't drive frequently.

- Review your policy annually to ensure you are receiving all the discounts you are eligible for.

Shopping Around for Quotes

When it comes to saving money on your auto insurance, one of the most crucial steps is to shop around for quotes from multiple insurance providers. This allows you to compare prices, coverage options, and potential discounts to find the best deal.

Comparing Quotes and Coverage Options

- Obtain quotes from at least three different insurance companies to get a good range of prices and coverage options.

- Compare the coverage limits, deductibles, and additional benefits offered by each provider to ensure you are getting adequate protection.

- Take note of any exclusions or limitations in the policies that could impact your decision.

Negotiating for Better Rates

- Once you have gathered multiple quotes, don't be afraid to negotiate with insurance companies for better rates.

- Highlight any discounts or savings opportunities you may have found from other providers to see if they can match or beat them.

- Consider bundling your auto insurance with other policies or increasing your deductible to lower your premiums.

Usage-Based Insurance Programs

Usage-based insurance programs, also known as telematics programs, involve using technology to monitor your driving habits and adjust your insurance rates accordingly. This can lead to potential cost savings based on your actual driving behavior.

How Usage-Based Insurance Works and Potential Savings

- Telematics devices or smartphone apps track data such as mileage, speed, braking, and time of day you drive.

- Insurers use this data to assess your risk level and may offer discounts for safe driving habits.

- By driving less, avoiding hard braking, and driving during low-risk times, you can potentially lower your insurance premiums.

Benefits of Opting for a Usage-Based Insurance Policy

- Opportunity to save money based on actual driving habits.

- Encourages safer driving behavior, leading to reduced accident risk.

- Potential for discounts for young or new drivers who demonstrate safe driving.

Drawbacks of Usage-Based Insurance

- Potential privacy concerns with constant monitoring of driving habits.

- May not be suitable for drivers who have erratic or high-risk driving patterns.

- Data collection may impact premium rates negatively if driving habits are deemed risky.

Tips for Utilizing Usage-Based Insurance to Save Money

- Understand how your driving habits affect your insurance rates.

- Practice safe driving behaviors to qualify for discounts.

- Regularly review your driving data to identify areas for improvement.

- Consider opting for a usage-based insurance policy if you have safe driving habits and want to potentially lower your premiums.

Summary

In conclusion, understanding how to save money on your auto insurance quote every year can lead to significant long-term savings. By leveraging the information and tips provided in this guide, you can make well-informed choices that align with your budget and coverage needs.

FAQ Explained

What factors can impact auto insurance rates?

Factors such as age, location, driving history, and type of vehicle can all influence auto insurance rates. By understanding these factors, individuals can potentially find ways to lower their insurance premiums.

How do usage-based insurance programs work?

Usage-based insurance programs track driving behavior to determine insurance costs. This can be a cost-saving option for individuals who exhibit safe driving habits.

What are some common discounts offered by auto insurance companies?

Common discounts include bundling policies, maintaining a good driving record, and installing safety devices in your vehicle. Taking advantage of these discounts can lead to savings on auto insurance.