Delving into Shop Auto Insurance for Luxury Cars: What to Expect, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

The content of the second paragraph that provides descriptive and clear information about the topic

Researching Luxury Car Insurance Providers

When looking for insurance coverage for your luxury car, it's essential to research and compare different providers to ensure you get the best coverage at the most competitive rates. Here are some key points to consider:

Identify Top Insurance Companies

- Begin by identifying the top insurance companies that specialize in providing coverage for luxury vehicles. Companies like Geico, Allstate, and State Farm are known for offering tailored policies for high-end cars.

- Research their reputation in the industry, their financial stability, and their track record of handling claims efficiently.

Importance of Choosing a Reputable Provider

- Choosing a reputable and reliable insurance provider for your luxury car is crucial to ensure that you receive adequate coverage in case of an accident or damage.

- A reliable provider will offer comprehensive coverage options that are specifically designed for luxury vehicles, giving you peace of mind knowing that your investment is protected.

- Check customer reviews and ratings to gauge the satisfaction levels of policyholders with the company's service and claims process.

Compare Coverage Options, Rates, and Customer Reviews

- Once you have identified a few insurance providers, compare the coverage options they offer for luxury cars. Look for policies that include coverage for exotic materials, high-value parts, and specialized repairs.

- Compare the rates of each provider to ensure you are getting a competitive premium for the coverage you need.

- Read customer reviews to get an idea of the level of customer service and claims satisfaction provided by each insurance company.

Understanding Coverage Options for Luxury Cars

When it comes to insuring a luxury car, it's essential to understand the different coverage options available to protect your valuable investment. Let's explore the various types of coverage and additional options specific to luxury vehicles.

Types of Coverage

- Comprehensive Coverage: This type of coverage protects your luxury car from non-collision incidents, such as theft, vandalism, fire, or natural disasters.

- Collision Coverage: Collision coverage helps pay for repairs or replacement if your luxury car is damaged in a collision with another vehicle or object.

- Liability Coverage: Liability coverage is essential for luxury car owners to cover damages or injuries to others in an accident where you are at fault.

Additional Coverage Options

- Exotic Car Coverage: Some insurance providers offer specialized coverage for exotic luxury cars, which may include higher coverage limits and unique protections.

- Agreed Value Coverage: Agreed value coverage ensures that in the event of a total loss, you will receive a pre-agreed amount for your luxury car, taking into account its true value.

Examples of Scenarios:

Comprehensive Coverage

Imagine your luxury car gets stolen from a parking lot. With comprehensive coverage, you can receive compensation for the theft.

Collision Coverage

If you accidentally hit a tree while driving your luxury car, collision coverage would help cover the cost of repairs.

Liability Coverage

In a situation where you rear-end another vehicle, liability coverage would assist in paying for the damages to the other driver's car.

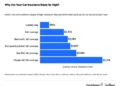

Factors Influencing Auto Insurance Rates for Luxury Cars

When it comes to insuring luxury cars, several factors come into play that can significantly influence the insurance rates. Understanding these factors can help you make informed decisions and potentially save money on premiums.

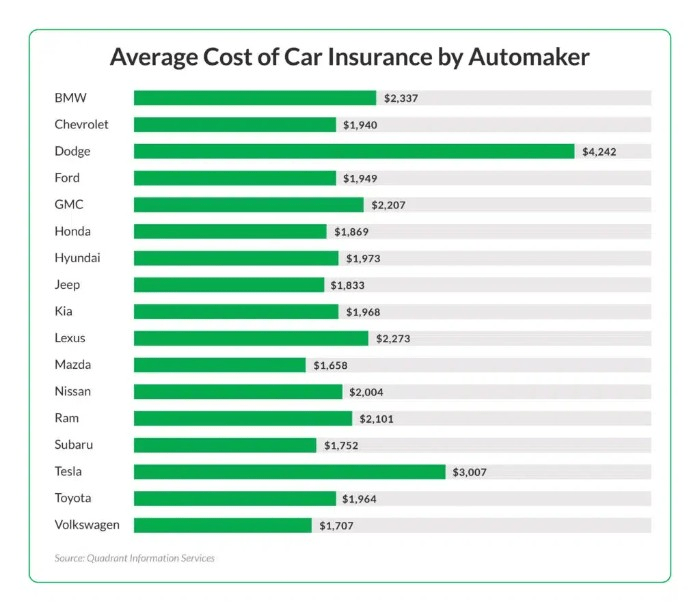

Car’s Make and Model

The make and model of a luxury car play a crucial role in determining insurance rates. Generally, high-end luxury vehicles with expensive parts and advanced technology are more costly to insure due to the higher repair or replacement costs.

Safety Features

Luxury cars often come equipped with advanced safety features like collision warning systems, adaptive cruise control, and lane-keeping assistance. Vehicles with these safety features are considered less risky and may qualify for lower insurance premiums.

Driving History

Your driving history, including any past accidents, speeding tickets, or traffic violations, can impact your insurance rates. Safe drivers with a clean record are likely to receive lower premiums compared to those with a history of accidents or violations.

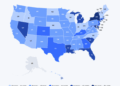

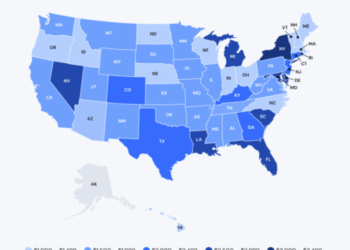

Location, Usage, and Storage

Where you live, how often you drive your luxury car, and where you park or store it can also affect insurance rates. Urban areas with higher rates of accidents or theft may result in higher premiums. Additionally, using your luxury car for long commutes or business purposes may increase insurance costs.

Personal Credit Score and Insurance Deductible

Insurance companies may consider your credit score when calculating premiums for luxury car insurance. A higher credit score can demonstrate financial responsibility and may lead to lower rates. Moreover, choosing a higher deductible can lower your premiums, but it means you'll pay more out of pocket in the event of a claim.

Tips for Lowering Insurance Costs for Luxury Cars

When it comes to insuring luxury cars, the premiums can be quite high due to the expensive nature of these vehicles. However, there are several strategies you can use to lower your insurance costs and save money in the long run.

Bundling Policies

By bundling your auto insurance policy with other types of insurance, such as homeowners or renters insurance, you may be able to qualify for a multi-policy discount. This can help reduce the overall cost of insuring your luxury car.

Increasing Deductibles

Consider increasing your deductibles, which is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you may be able to lower your monthly insurance premiums. Just make sure you have enough savings to cover the deductible in case of an accident.

Installing Anti-Theft Devices

Another way to lower insurance costs for luxury cars is by installing anti-theft devices such as alarms, immobilizers, or tracking systems. These devices can help prevent theft and reduce the risk for insurance companies, potentially leading to lower premiums.

Maintaining a Clean Driving Record

One of the most effective ways to keep insurance costs down is by maintaining a clean driving record. Avoiding accidents and traffic violations can demonstrate to insurance companies that you are a responsible driver, which can lead to lower rates.

Attending Defensive Driving Courses

Taking defensive driving courses can also help lower insurance costs for luxury cars. These courses can improve your driving skills and reduce the likelihood of accidents, making you a less risky driver in the eyes of insurance companies.

Negotiating with Insurance Companies

Don't be afraid to negotiate with insurance companies for discounts or customized coverage options for your luxury vehicle. You may be able to tailor your policy to better fit your needs and budget by discussing your options with your insurance provider.

Final Summary

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Answers to Common Questions

What factors can affect auto insurance rates for luxury cars?

Factors such as the car's make and model, safety features, driving history, location, usage, and storage can influence insurance premiums for luxury vehicles.

How can insurance costs for luxury cars be lowered?

Strategies like bundling policies, increasing deductibles, and installing anti-theft devices can help reduce insurance premiums for luxury cars. Additionally, maintaining a clean driving record and attending defensive driving courses can also lower costs. Negotiating with insurance companies for discounts or customized coverage options is another effective way to lower insurance costs for luxury vehicles.