Shop Car Insurance Quotes with No Hidden Fees sets the stage for this comprehensive guide, offering readers insights into the world of car insurance pricing. From understanding how quotes work to shopping effectively and avoiding hidden fees, this guide covers it all in detail.

As we delve into the intricacies of car insurance quotes, you'll find valuable tips and strategies to make informed decisions when selecting the right coverage for your vehicle.

Understanding Car Insurance Quotes

Car insurance quotes provide estimates of the cost of insuring your vehicle based on various factors. These quotes are calculated by insurance companies using information such as your driving record, age, location, type of vehicle, and coverage options.

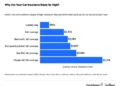

Factors Influencing Car Insurance Quotes

- Your driving record: A history of accidents or traffic violations can lead to higher quotes.

- Age and experience: Younger and less experienced drivers typically pay more for insurance.

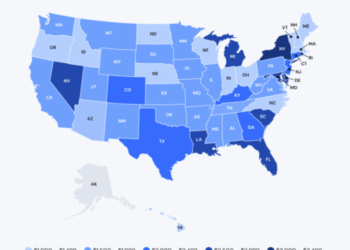

- Location: Urban areas with higher rates of accidents or theft may result in higher quotes.

- Type of vehicle: The make, model, and age of your car can affect insurance costs.

- Coverage options: Different types of coverage, such as liability, comprehensive, and collision, impact the overall quote.

Types of Coverage Included in Insurance Quotes

- Liability coverage: Covers damages to other people or property in an accident you are responsible for.

- Comprehensive coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Collision coverage: Pays for repairs or replacement of your vehicle in case of a collision with another vehicle or object.

- Personal injury protection: Covers medical expenses for you and your passengers in case of an accident.

- Uninsured/underinsured motorist coverage: Protects you if you are in an accident with a driver who has insufficient or no insurance.

Shopping for Car Insurance Quotes

When it comes to shopping for car insurance quotes, it's important to compare different options effectively to find the best coverage at the most competitive rates. Checking for hidden fees in insurance quotes is crucial to avoid any surprises later on.

Here is a step-by-step guide on how to shop for car insurance quotes online:

Tips on How to Compare Car Insurance Quotes Effectively

- Start by gathering information about your vehicle, driving history, and any specific coverage needs you may have.

- Get quotes from multiple insurance companies to compare rates, coverage options, and discounts offered.

- Consider factors such as deductible amounts, coverage limits, and additional benefits when comparing quotes.

- Look for customer reviews and ratings to gauge the level of customer service and satisfaction provided by each insurance company.

- Don't forget to inquire about any available discounts that may apply to your situation, such as safe driver discounts or multi-policy discounts.

Importance of Checking for Hidden Fees in Insurance Quotes

- Hidden fees in insurance quotes can significantly impact the overall cost of your coverage, making it essential to carefully review the details of each quote.

- Be on the lookout for additional charges like processing fees, administrative fees, or other hidden costs that may not be clearly disclosed upfront.

- Understanding the full cost of your insurance policy, including any hidden fees, can help you make an informed decision and avoid any financial surprises down the line.

Step-by-Step Guide on How to Shop for Car Insurance Quotes Online

- Start by visiting the websites of reputable insurance companies or using comparison websites to obtain quotes.

- Enter your personal information, vehicle details, and coverage preferences to receive tailored quotes from different providers.

- Review each quote carefully, paying attention to coverage options, deductibles, limits, and any additional fees or discounts included.

- Compare the quotes side by side to determine which policy offers the best value for your specific needs and budget.

- Contact the insurance companies directly to ask any questions or clarify details before making a final decision on your car insurance policy.

No Hidden Fees in Car Insurance Quotes

When obtaining car insurance quotes, it is essential to be aware of any potential hidden fees that may not be immediately obvious. These fees can significantly impact the overall cost of your insurance policy, so it is crucial to understand what they are and how to identify them.

Common Hidden Fees in Car Insurance Quotes

When comparing car insurance quotes, keep an eye out for the following common hidden fees:

- Processing fees: Some insurance companies may charge processing fees to set up your policy.

- Policy fees: These are additional fees charged for administrative costs related to your policy.

- Installment fees: If you choose to pay your premium in installments, you may incur extra fees.

- Underwriting fees: Some insurers charge fees for the underwriting process to assess your risk.

Identifying and Avoiding Hidden Fees

Here are some tips to help you identify and avoid hidden fees when comparing car insurance quotes:

- Read the fine print: Carefully review the terms and conditions of each quote to look for any mention of additional fees.

- Ask questions: Don't hesitate to ask the insurance provider about any fees that are not clearly Artikeld in the quote.

- Compare total costs: Instead of just focusing on the premium amount, consider the total cost of the policy, including any potential hidden fees.

- Shop around: Obtain quotes from multiple insurers to compare not only the premiums but also any additional fees that may be included.

Transparency in Car Insurance Pricing

Transparency in car insurance pricing is essential for consumers to make informed decisions and understand the cost breakdown of their coverage. It allows policyholders to see exactly what they are paying for and helps build trust between the insurance company and the customer.

Insurance Companies Known for Transparent Pricing

- Progressive: Progressive is known for its transparency in pricing, offering tools like Name Your Price® Tool that allows customers to customize their coverage based on their budget.

- Geico: Geico provides clear and detailed pricing information on their website, making it easy for customers to compare quotes and understand the cost of different coverage options.

- Allstate: Allstate offers transparency through its online quote tool, providing detailed explanations of coverage options and pricing factors.

Strategies for Finding Car Insurance Quotes with Transparent Pricing

- Compare Multiple Quotes: Obtain quotes from different insurance companies to compare pricing and coverage options, ensuring transparency in the pricing structure.

- Read Policy Details: Take the time to read through the policy details and ask questions about any unclear pricing information to ensure there are no hidden fees.

- Look for Online Tools: Utilize online tools provided by insurance companies to customize your coverage and see a breakdown of pricing based on your selections.

Last Recap

In conclusion, navigating the realm of car insurance quotes without hidden fees is crucial for consumers seeking transparency and value. By following the tips Artikeld in this guide, you can confidently shop for car insurance while avoiding unexpected costs.

Quick FAQs

What are hidden fees in car insurance quotes?

Hidden fees in car insurance quotes refer to additional charges that are not clearly disclosed upfront, potentially leading to higher costs for consumers.

How can consumers identify hidden fees when comparing quotes?

Consumers can identify hidden fees by carefully reviewing the fine print, asking insurance providers directly about any potential extra charges, and comparing quotes from multiple sources.

Why is transparency in car insurance pricing important?

Transparency in car insurance pricing ensures that consumers have a clear understanding of the costs involved and can make informed decisions without facing unexpected charges.