Starting your search for auto insurance quotes online can be a daunting task, but with the right approach, it can be a breeze. In this guide, we'll explore the most efficient ways to get free auto insurance quotes online, helping you save time and money while finding the best coverage for your needs.

We'll delve into the key steps involved in the process, from identifying reputable websites to understanding different types of coverage and factors that influence insurance quotes. By the end, you'll be equipped with the knowledge to make informed decisions about your auto insurance options.

How to Start Your Search for Auto Insurance Quotes Online

When looking for auto insurance quotes online, it's important to start your search on reputable websites that offer free quotes. These websites can provide you with a range of options to choose from, helping you find the best coverage at the most competitive rates.

Identify Reputable Websites

- Look for websites of well-known insurance companies or comparison websites that specialize in offering auto insurance quotes.

- Check for customer reviews and ratings to ensure the website is trustworthy and reliable.

- Avoid websites that ask for payment or personal information upfront for providing quotes.

Compare Quotes from Multiple Sources

- Obtain quotes from at least three different sources to compare coverage options and prices.

- Consider factors like deductibles, coverage limits, and additional benefits when comparing quotes.

- Choose the quote that offers the best value for your specific insurance needs.

Input Accurate Information

- Provide accurate and up-to-date information about your driving history, vehicle, and coverage requirements.

- Double-check the details you enter to ensure the quotes you receive are based on correct information.

- Be honest about your driving record and any previous claims to receive the most precise quotes.

Factors to Consider When Getting Auto Insurance Quotes Online

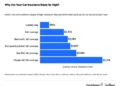

When obtaining auto insurance quotes online, several factors can significantly impact the cost of your coverage. It is essential to understand how these factors influence the quotes you receive and how you can potentially lower your insurance costs based on these considerations.

Age

Age plays a crucial role in determining auto insurance rates. Typically, younger drivers under the age of 25 may face higher premiums due to their lack of driving experience. On the other hand, older drivers over the age of 65 might also see increased rates due to potential health concerns.

To potentially lower your insurance quotes based on age, consider taking defensive driving courses or bundling policies for discounts.

Driving Record

Your driving record is another critical factor that insurance providers consider when calculating your rates. A clean driving record with no accidents or traffic violations can result in lower premiums, while a history of accidents or citations may lead to higher costs.

To potentially reduce insurance quotes based on your driving record, focus on maintaining a safe driving record and consider enrolling in programs that offer safe driving discounts.

Vehicle Type

The type of vehicle you drive can also impact your auto insurance quotes. High-performance cars, luxury vehicles, and models with expensive repair costs may result in higher premiums. On the other hand, driving a reliable and safe vehicle with advanced safety features can help lower insurance costs.

To potentially lower your insurance quotes based on vehicle type, consider choosing a car with good safety ratings and anti-theft devices.

Understanding Different Types of Auto Insurance Coverage

When it comes to auto insurance, there are several types of coverage options available to protect you and your vehicle. It's essential to understand the different types of coverage to ensure you have the right protection in place.

Liability Coverage

- Liability coverage helps pay for the other party's expenses if you are at fault in an accident.

- It typically includes bodily injury liability and property damage liability.

- For example, if you rear-end another car and cause injuries to the driver, your liability coverage would help cover their medical expenses.

Comprehensive Coverage

- Comprehensive coverage protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- It is optional but can provide valuable coverage for unexpected events.

- For instance, if a tree falls on your car during a storm, comprehensive coverage would help cover the repair costs.

Collision Coverage

- Collision coverage helps pay for damage to your vehicle in a collision with another vehicle or object.

- It is also optional but can be beneficial, especially if you have a newer car.

- For example, if you hit a pole while parking and damage your car, collision coverage would help cover the repair expenses.

Uninsured/Underinsured Motorist Coverage

- This coverage protects you if you are in an accident caused by a driver who doesn't have insurance or enough insurance to cover your damages.

- It can help with medical expenses and vehicle repairs in such situations.

- For instance, if you are hit by an uninsured driver and sustain injuries, uninsured/underinsured motorist coverage would help cover your medical bills.

Tips for Saving Money on Auto Insurance

When it comes to auto insurance, finding ways to save money while still getting adequate coverage is a top priority for many people. Here are some tips to help you reduce your insurance costs without compromising on protection.

Consider Higher Deductibles

Raising your deductible can lower your monthly premium. Just make sure you have enough savings to cover the higher deductible if you need to make a claim.

Take Advantage of Discounts

Many insurance companies offer discounts for various reasons, such as having a clean driving record, bundling policies, or completing a defensive driving course. Be sure to ask about available discounts when getting online quotes.

Shop Around for the Best Rates

Don't settle for the first quote you receive. Compare rates from multiple insurance companies to ensure you are getting the best value for your money. Online comparison tools can make this process quick and easy.

Consider Dropping Comprehensive and Collision Coverage for Older Vehicles

If you have an older car that is paid off, you may want to consider dropping comprehensive and collision coverage. The cost of the coverage may be higher than the value of the car, making it not worth the expense.

Bundle Your Policies

Insurance companies often offer discounts for bundling multiple policies, such as auto and home insurance. This can result in significant savings on your premiums.

Outcome Summary

In conclusion, navigating the world of auto insurance quotes online doesn't have to be overwhelming. By following the tips and strategies Artikeld in this guide, you can simplify the process and secure the coverage that fits your budget and requirements.

Remember, getting free auto insurance quotes online is just a few clicks away, so don't hesitate to start your search today.

Q&A

How can I ensure I'm getting accurate quotes?

Inputting precise and up-to-date information about your driving history, vehicle, and coverage needs is crucial to receiving accurate auto insurance quotes online.

Are there any specific discounts I should look out for when getting online quotes?

Common discounts to inquire about include safe driver discounts, multi-policy discounts, and discounts for vehicle safety features.

What factors have the most significant impact on insurance costs?

Factors such as age, driving record, vehicle make and model, and coverage options chosen can greatly influence the cost of auto insurance.