As Top 10 Tips to Lower Your Auto Insurance Quote Fast takes center stage, this opening passage beckons readers with a wealth of knowledge on the topic, promising an informative and engaging discussion ahead.

In the following paragraph, you will find a comprehensive overview of the subject matter, providing valuable insights to help you navigate the world of auto insurance quotes with ease.

Understanding Auto Insurance Quotes

When it comes to auto insurance, understanding the quotes you receive is crucial in order to make informed decisions. Here are some key points to consider:

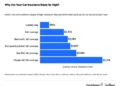

Factors Influencing Auto Insurance Quotes

- Driving Record: Your driving history, including any accidents or traffic violations, can significantly impact your insurance premium.

- Age and Gender: Younger drivers and males typically pay higher premiums due to higher risk factors.

- Vehicle Type: The make and model of your car, as well as its age and safety features, can affect your insurance costs.

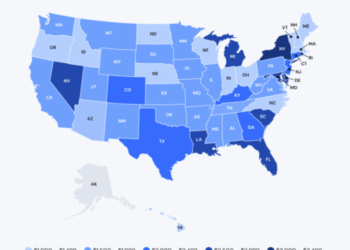

- Location: Where you live and drive can impact your insurance rates, with urban areas typically having higher premiums.

Shopping Around for Quotes

It's important to compare quotes from multiple insurance providers to ensure you are getting the best deal. Don't settle for the first quote you receive, as prices can vary between companies.

Reading and Comparing Quotes

- Look at the coverage limits and deductibles offered in each quote to ensure you are comparing apples to apples.

- Consider the reputation and customer service of the insurance company when evaluating quotes.

- Take note of any additional discounts or benefits offered by each provider.

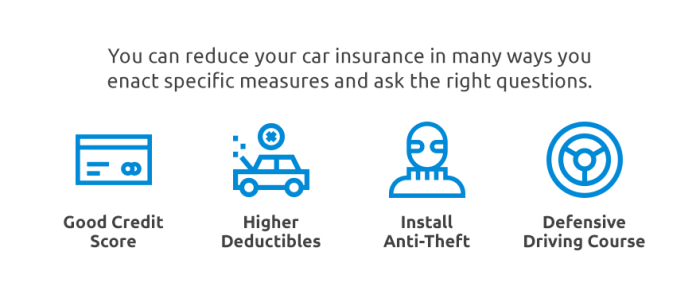

Discounts to Lower Your Premium

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as home or renters insurance, can lead to savings.

- Good Driver Discount: Maintaining a clean driving record can result in lower premiums.

- Vehicle Safety Features: Installing anti-theft devices or safety features like airbags can qualify you for discounts.

- Low Mileage Discount: If you don't drive often, you may be eligible for a lower premium.

Maintaining a Good Driving Record

Maintaining a good driving record is crucial when it comes to lowering your auto insurance quote. Insurance companies often assess your driving history to determine the level of risk you pose as a driver. A clean driving record shows that you are a responsible and safe driver, which can result in lower insurance premiums.

Impact of a Clean Driving Record

Having a clean driving record can significantly impact your insurance quotes. Insurance companies typically offer lower rates to drivers with no history of accidents, traffic violations, or claims. On the other hand, drivers with a history of speeding tickets, accidents, or DUIs are considered high-risk and may face higher premiums.

- Drive defensively: Always stay focused on the road, avoid distractions, and anticipate potential hazards to prevent accidents.

- Obey traffic laws: Follow speed limits, traffic signals, and other road rules to reduce the risk of getting tickets.

- Avoid distractions: Put away your phone, avoid eating while driving, and refrain from any activities that may take your attention away from the road.

- Regular maintenance: Ensure your vehicle is in good working condition to prevent breakdowns or accidents caused by mechanical failures.

- Take defensive driving courses: Some insurance companies offer discounts to drivers who complete defensive driving courses, which can also help improve your driving skills.

Choosing the Right Coverage

When it comes to choosing the right coverage for your auto insurance, it's essential to understand the different types of coverage options available and how they can benefit you. Selecting appropriate coverage tailored to your needs can not only provide financial protection but also give you peace of mind on the road.

Here are some insights on how to assess the right level of coverage for your vehicle.

Compare Different Types of Coverage Options

- Liability Coverage: This type of coverage helps pay for the other party's expenses if you are at fault in an accident.

- Collision Coverage: This coverage helps pay for repairs to your vehicle in case of a collision with another vehicle or object.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage helps protect you in case you are involved in an accident with a driver who doesn't have insurance or enough coverage.

Importance of Selecting Appropriate Coverage

- Having the right coverage can prevent you from facing significant financial burdens in case of an accident.

- Choosing appropriate coverage ensures that you are protected against various risks that you may encounter on the road.

- Customizing your coverage based on your needs can give you the peace of mind that you are adequately protected.

Assessing the Right Level of Coverage for Your Vehicle

- Consider the value of your vehicle and how much you can afford to pay out of pocket in case of an accident.

- Assess the risks you face based on your driving habits, the area you live in, and other factors that may affect your vehicle's safety.

- Consult with your insurance agent to understand the coverage options available and determine the most suitable level of coverage for your specific situation.

Increasing Deductibles

When it comes to auto insurance, one way to lower your insurance premiums is by increasing your deductibles. Deductibles are the amount of money you agree to pay out of pocket before your insurance kicks in to cover the rest of the expenses in the event of a claim.

Here are some tips on how increasing deductibles can help lower your insurance quotes.

Choosing the Right Deductible Amount

- Consider your financial situation: Before increasing your deductible, make sure you can afford to pay the higher amount out of pocket in case of an accident.

- Balance between savings and risk: Find a deductible amount that offers you significant savings on your premiums while still being a manageable amount to pay if needed.

- Consult with your insurance agent: Your insurance agent can provide you with guidance on the right deductible amount based on your specific needs and circumstances.

How Increasing Deductibles Can Help Lower Insurance Quotes

- Lower premiums: By opting for a higher deductible, insurance companies see you as less of a risk and may offer you lower premiums.

- Encourages safe driving: Knowing you have a higher deductible may encourage you to drive more cautiously to avoid accidents, ultimately leading to fewer claims and lower premiums.

- Savings over time: While you may have to pay more out of pocket if a claim arises, the savings you accumulate from lower premiums can outweigh the higher deductible amount in the long run.

Bundling Insurance Policies

When it comes to lowering your auto insurance costs, bundling insurance policies can be a smart move. By combining your auto insurance with other insurance policies, you can enjoy various benefits that can lead to discounts and overall cost savings.

Benefits of Bundling

- Bundling your auto insurance with other policies such as home, renters, or life insurance can often result in discounts on your premiums.

- Insurance companies appreciate customer loyalty and are more likely to offer lower rates when you bundle multiple policies with them.

- Managing multiple insurance policies under one provider can also simplify your paperwork and billing process, making it more convenient for you.

Common Insurance Policies to Bundle

- Home Insurance:Bundling your auto insurance with your homeowner's insurance is a common practice that can lead to significant savings.

- Renters Insurance:If you rent your home, consider bundling your auto insurance with renters insurance to enjoy discounts.

- Life Insurance:Some insurance companies offer discounts when you bundle your auto insurance with a life insurance policy, providing you with added protection and savings.

Improving Credit Score

Improving your credit score can have a significant impact on your auto insurance premiums. Insurance companies often use credit-based insurance scores to determine the likelihood of a policyholder filing a claim. A higher credit score is typically associated with lower insurance costs, as it is seen as a reflection of financial responsibility and lower risk.

Tips to Improve Credit Score for Lower Insurance Costs

- Pay bills on time: Late payments can negatively impact your credit score. Make sure to pay all your bills, including credit card bills and loan payments, on time.

- Reduce credit card balances: High credit card balances relative to your credit limit can lower your credit score. Try to keep your credit card balances low to improve your score.

- Avoid opening new credit accounts: Opening multiple new credit accounts in a short period can lower your average account age and negatively impact your credit score.

- Check your credit report regularly: Errors on your credit report can hurt your credit score. Monitor your credit report regularly and dispute any inaccuracies.

Improving your credit score not only has the potential to lower your auto insurance premiums but can also benefit you in other financial aspects of your life.

Impact of Credit-Based Insurance Scores on Quotes

- Insurance companies use credit-based insurance scores as a factor in determining premiums.

- States have different regulations regarding the use of credit scores in insurance rating, so it's important to be aware of the laws in your state.

- Policyholders with higher credit-based insurance scores may be eligible for lower insurance rates.

Driving Less or Carpooling

Driving less or carpooling can have a significant impact on your auto insurance premiums. By reducing your mileage or sharing rides with others, you can lower your insurance costs. Here are some tips on how to achieve this:

Reducing Mileage to Lower Insurance Costs

- Avoid unnecessary trips and combine errands to minimize driving.

- Consider walking, biking, or using public transportation for short distances.

- Telecommute or work from home if possible to reduce daily commuting mileage.

- Plan efficient routes to minimize driving distances.

Carpooling as a Way to Decrease Insurance Quotes

- Join a carpooling group with coworkers, friends, or neighbors to share rides to work or other destinations.

- Rotate driving responsibilities to distribute mileage among group members.

- Utilize carpool lanes to save time and reduce wear and tear on your vehicle.

- Check with your insurance provider to see if they offer discounts for carpooling.

Installing Safety Features

Installing safety features in your vehicle can have a positive impact on your auto insurance premiums. Insurance companies view vehicles with advanced safety features as less risky, which can lead to lower insurance quotes.

Types of Safety Features

- Anti-lock brakes (ABS): ABS help prevent the wheels from locking up during braking, improving control and reducing the risk of accidents.

- Electronic stability control (ESC): ESC helps maintain vehicle stability and prevent skidding on slippery roads.

- Adaptive headlights: These headlights adjust to the steering angle of the vehicle, providing better visibility around curves.

- Blind-spot detection: This feature alerts drivers of vehicles in their blind spots, reducing the risk of collisions during lane changes.

Examples of Vehicles with Advanced Safety Features

- The Subaru Outback comes equipped with EyeSight Driver Assist Technology, which includes features like adaptive cruise control, pre-collision braking, and lane keep assist.

- The Toyota Camry offers Toyota Safety Sense, which includes a pre-collision system with pedestrian detection, lane departure alert with steering assist, and automatic high beams.

- The Honda CR-V includes the Honda Sensing suite, featuring collision mitigation braking system, road departure mitigation, adaptive cruise control, and lane keeping assist system.

Inquiring About Discounts

When looking to lower your auto insurance costs, it's essential to inquire about available discounts from your insurance provider. By taking advantage of discounts, you can potentially reduce your insurance rates and save money. Here are some tips on how to qualify for discounts and maximize your savings.

Common Discounts Offered by Insurance Companies

- Multi-policy discount: Many insurance companies offer discounts if you bundle multiple insurance policies, such as auto and home insurance, with them.

- Good student discount: Students with good academic records may qualify for a discount on their auto insurance premiums.

- Safe driver discount: Maintaining a clean driving record with no accidents or traffic violations can make you eligible for a safe driver discount.

- Low-mileage discount: If you drive fewer miles than the average driver, you may be eligible for a low-mileage discount.

- Affiliation discounts: Some insurance companies offer discounts to members of certain organizations or affinity groups.

Tips to Qualify for Discounts and Reduce Insurance Rates

- Ask your insurance provider about available discounts: Make sure to inquire about all the discounts that you may qualify for.

- Maintain a good driving record: Avoid accidents and traffic violations to improve your chances of qualifying for safe driver discounts.

- Consider increasing your deductibles: Opting for higher deductibles can lower your insurance premiums and make you eligible for additional discounts.

- Improve your credit score: A good credit score can help you qualify for discounts on your auto insurance.

- Drive less or carpool: Reducing your mileage by carpooling or using alternative transportation methods can qualify you for low-mileage discounts.

Reviewing and Updating Policy Regularly

It is crucial to review and update your auto insurance policy regularly to ensure you have the right coverage and are not overpaying for unnecessary features. By keeping your policy up to date, you can potentially lower your insurance quotes and save money in the long run.

Importance of Reviewing Your Policy Periodically

Regularly reviewing your policy allows you to make any necessary changes based on your current situation. Life changes such as moving to a new location, buying a new car, or even getting married can impact your insurance needs. By staying informed about your policy details, you can ensure you are adequately covered at the best price.

Why Updating Your Policy Can Help Lower Insurance Quotes

Updating your policy can help lower insurance quotes by eliminating coverage you no longer need, adding discounts you qualify for, or adjusting your deductibles. Insurance companies may offer new discounts or promotions periodically, so staying up to date on your policy can help you take advantage of these savings opportunities.

Tips on What to Look for When Reviewing and Updating Your Auto Insurance Policy

- Check for any changes in your driving habits or lifestyle that may impact your coverage needs.

- Review your coverage limits to ensure they still align with your financial situation and assets.

- Compare quotes from different insurance providers to see if you can get a better deal elsewhere.

- Ask your insurance agent about any new discounts or programs that you may qualify for.

- Consider adjusting your deductibles to lower your premium costs, but make sure you can afford the out-of-pocket expenses in case of a claim.

Concluding Remarks

In conclusion, the discussion on Top 10 Tips to Lower Your Auto Insurance Quote Fast has shed light on various strategies to reduce insurance costs effectively. By implementing these tips, you can make informed decisions and potentially save money on your auto insurance premiums.

Commonly Asked Questions

Question: What factors influence auto insurance quotes?

Answer: Factors such as driving record, coverage options, deductibles, and credit score can all influence auto insurance quotes.

Question: How can I improve my credit score to lower insurance costs?

Answer: To improve your credit score, you can pay bills on time, keep credit card balances low, and monitor your credit report regularly.

Question: Why is it important to review and update your policy regularly?

Answer: Regularly reviewing and updating your policy ensures that you have adequate coverage and can help identify opportunities to lower insurance costs.