What Information You Need Before Requesting an Auto Insurance Quote sets the stage for this informative discussion, providing a comprehensive look into the essential details required to navigate the world of auto insurance quotes.

This topic delves into the crucial factors influencing insurance costs, the necessary information for obtaining quotes, and the various coverage options available, offering readers a well-rounded view of the subject matter.

Factors Affecting Auto Insurance Quotes

When requesting an auto insurance quote, several factors come into play that can significantly impact the cost of your premium. Understanding these factors can help you make informed decisions and potentially save money on your insurance coverage.

Personal Information Influence

- Your age: Younger drivers typically face higher insurance premiums due to their lack of experience on the road.

- Driving record: A clean driving record with no accidents or traffic violations can lead to lower insurance costs.

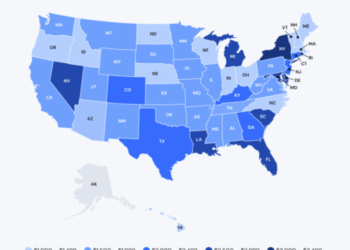

- Location: Urban areas with higher rates of accidents and thefts may result in higher insurance premiums compared to rural areas.

Vehicle Make, Model, and Usage Impact

- Vehicle make and model: Luxury cars or sports vehicles are often more expensive to insure due to higher repair costs and increased risk of theft.

- Vehicle usage: How you use your vehicle, such as for commuting or leisure, can affect your insurance rates. Higher mileage or frequent use may lead to higher premiums.

Coverage Types and Limits

- The types of coverage you choose, such as liability, collision, and comprehensive, will impact your insurance quote. More coverage means higher premiums.

- Policy limits: Higher coverage limits provide more protection but also result in higher insurance costs. Choosing lower limits can help reduce premiums.

Required Information for Requesting an Auto Insurance Quote

When requesting an auto insurance quote, it is essential to provide accurate and detailed information to ensure you receive an accurate price estimate. Here are the key pieces of information typically required:

Personal Information

- Name

- Address

- Date of Birth

Providing your personal information is crucial for insurance companies to identify you and determine the appropriate coverage options.

Driving History Details

- Accidents

- Traffic violations

- Claims history

Accurate driving history details help insurers assess your risk level as a driver, which can impact the cost of your auto insurance premium.

Vehicle Information

- Make

- Model

- Vehicle Identification Number (VIN)

Vehicle information such as make, model, and VIN is crucial as it helps determine the specific coverage needed for your car, based on factors like its value, safety features, and potential repair costs.

Understanding Coverage Options

When it comes to auto insurance, understanding the different coverage options available is crucial in making informed decisions. This includes liability, collision, and comprehensive coverage, each serving a unique purpose in protecting you and your vehicle.

Types of Coverage

- Liability Coverage: This type of coverage helps pay for damages or injuries you cause to others in an accident. It is typically required by law and consists of two parts - bodily injury liability and property damage liability.

- Collision Coverage: Collision coverage helps pay for repairs to your vehicle if you are involved in an accident, regardless of fault. This coverage is especially important for newer or more valuable vehicles.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from damages not caused by a collision, such as theft, vandalism, or natural disasters. It provides coverage for a wide range of scenarios that could damage your vehicle.

Choosing the right combination of coverage options is essential to ensure you are adequately protected in various situations.

Impact of Deductibles and Coverage Limits

- Deductibles: A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it also means you'll have to pay more if you file a claim.

- Coverage Limits: Coverage limits determine the maximum amount your insurance company will pay for a covered claim. It's important to select coverage limits that align with your assets and potential liabilities to avoid being underinsured.

Factors that Can Lower Insurance Quotes

When it comes to lowering your auto insurance quotes, there are several factors that can positively impact the cost of your premiums. By understanding these factors, you can take steps to potentially reduce your insurance expenses.

Maintaining a Clean Driving Record

Having a clean driving record is one of the most effective ways to lower your insurance quotes. Insurance companies typically offer lower rates to drivers with a history of safe driving, as they are considered less risky to insure. To maintain a clean driving record, it's important to follow traffic laws, avoid accidents, and drive defensively at all times.

Bundling Auto Insurance with Other Policies

Another way to lower your auto insurance costs is by bundling your auto insurance with other policies, such as homeowners or renters insurance. Many insurance companies offer discounts to customers who purchase multiple policies from them, so bundling can lead to significant savings on your premiums.

Vehicle Safety Features and Anti-Theft Devices

Equipping your vehicle with safety features and anti-theft devices can also help reduce your insurance quotes. Cars that have safety features such as airbags, anti-lock brakes, and electronic stability control are considered safer to drive, which can result in lower premiums.

Additionally, anti-theft devices like alarms and tracking systems can deter theft and lower the risk of your car being stolen, leading to potential discounts from your insurance provider.

Summary

In conclusion, understanding the key information needed before requesting an auto insurance quote is vital for making informed decisions and securing the right coverage. With this knowledge in hand, individuals can navigate the insurance landscape with confidence and clarity.

FAQ Overview

What personal information is typically needed when requesting an auto insurance quote?

Insurance companies usually require details such as name, address, date of birth, and driving history to provide accurate quotes.

How do vehicle safety features and anti-theft devices affect insurance costs?

Having safety features and anti-theft devices can lead to discounts on insurance premiums as they reduce the risk of theft or accidents.

What impact does the choice of deductibles and coverage limits have on insurance quotes?

Choosing higher deductibles and lower coverage limits can lower insurance premiums but may also increase out-of-pocket expenses in case of a claim.

Is it important to provide accurate driving history details for an auto insurance quote?

Yes, accurate driving history details are crucial as they help insurers assess the level of risk a driver presents, which determines the insurance premium.