Exploring the timing of shopping for car insurance after relocating to a new state opens up a world of considerations and possibilities. From understanding the minimum requirements to navigating coverage options and discounts, this guide will help you make informed decisions for a smooth transition.

Factors to Consider When Shopping for Car Insurance After Moving to a New State

Moving to a new state can have a significant impact on your car insurance rates. It's crucial to understand the factors that can affect the cost of insurance in your new location to ensure you are adequately covered without overspending.

Minimum Car Insurance Requirements in the New State

Different states have varying minimum car insurance requirements that drivers must meet to legally operate a vehicle. These requirements typically include liability coverage for bodily injury and property damage. It's essential to familiarize yourself with the specific mandates in your new state to ensure compliance.

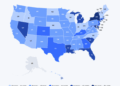

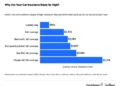

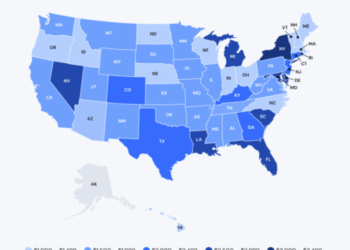

Cost of Car Insurance Based on the New Location

The cost of car insurance can vary greatly depending on the state you reside in. Factors such as population density, crime rates, weather conditions, and the number of uninsured drivers in the area can all impact insurance premiums. Urban areas with higher traffic congestion and crime rates may have higher insurance costs compared to rural areas.

Impact of Changes in Driving Habits or Distance to Work

Changes in your driving habits or commute distance can also influence your car insurance rates. If you now have a longer commute or if you work in an area with higher accident rates, your premiums may increase. Conversely, if you are driving less due to a change in lifestyle or working remotely, you may be eligible for lower rates.

It's essential to update your insurance provider with any changes to ensure you are accurately covered.

Researching Insurance Providers in the New State

When moving to a new state, it is crucial to research and compare different insurance providers to find the best coverage for your needs. Here are some tips on how to effectively research insurance companies in your new state.

Comparing Insurance Companies

- Start by compiling a list of insurance companies operating in your new state. You can use online resources or ask for recommendations from locals.

- Compare the coverage options, rates, and discounts offered by each insurance provider to determine which one best suits your needs and budget.

Checking Financial Stability and Customer Satisfaction

- Research the financial stability of insurance companies by checking their ratings from independent rating agencies such as A.M. Best, Standard & Poor's, or Moody's.

- Look up customer reviews and ratings on websites like J.D. Power or Consumer Reports to gauge the satisfaction levels of policyholders with each insurance provider.

Local Insurance Agents or Branches

- Consider choosing an insurance provider that has local agents or branches in your new state. Local agents can provide personalized assistance and guidance in understanding state-specific insurance requirements.

- Having a local agent can also be beneficial when filing a claim or seeking assistance with any issues that may arise, as they are familiar with the local regulations and processes.

Understanding Coverage Options and Discounts

When it comes to car insurance in a new state, it's essential to understand the different coverage options available to you, as well as any potential discounts that could help you save money on your premiums. Customizing your coverage to suit your individual needs is also crucial after a move.

Types of Coverage Options

- Liability Coverage: This covers damages and injuries you may cause to others in an accident.

- Collision Coverage: Helps pay for repairs to your car after a collision.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Covers you if you're in an accident with a driver who doesn't have insurance or enough coverage.

Common Discounts

- Multi-Policy Discount: Save money by bundling your car insurance with other policies like home insurance.

- Good Driver Discount: If you have a clean driving record, you may qualify for lower rates.

- Good Student Discount: Students with good grades can often get discounted rates.

- Low Mileage Discount: If you don't drive much, you may be eligible for savings.

Customizing Coverage

When shopping for car insurance in a new state, it's important to customize your coverage to meet your specific needs. Consider factors like your driving habits, the value of your vehicle, and your budget when selecting coverage options. Working with an insurance agent can help you tailor a policy that provides the right level of protection for you.

Setting a Timeline for Shopping and Switching Insurance

When you move to a new state, it's crucial to set a timeline for shopping and switching car insurance to ensure a smooth transition. Here's a guide to help you through the process:

Starting the Shopping Process

Once you've established residency in your new state, start shopping for car insurance right away. It's recommended to begin the process at least 30 days before your current policy expires to allow enough time for research, comparison, and decision-making.

- Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Consider factors such as state-specific insurance requirements, driving laws, and any discounts available in your new location.

- Review your current policy to understand your existing coverage and identify any changes needed in your new state.

Switching Insurance Providers

When you've selected a new insurance provider, follow these steps to switch seamlessly:

- Contact your current insurance company to inform them of your move and request cancellation of your policy.

- Purchase a new car insurance policy from the chosen provider and ensure coverage begins before your current policy expires.

- Provide all necessary documents, such as proof of residency, vehicle registration, and driver's license, to your new insurance company.

- Cancel automatic payments or recurring billing with your previous insurer to avoid any overlapping payments.

Grace Periods and Legal Requirements

It's essential to be aware of any grace periods or legal requirements for updating your car insurance after relocating:

Some states may have specific timeframes within which you must update your insurance information and register your vehicle in the new state. Failure to do so could result in penalties, fines, or even license suspension.

Remember to stay organized, keep track of deadlines, and seek guidance from your insurance provider or state department of motor vehicles if you have any questions regarding the process.

Summary

In conclusion, knowing when to shop for car insurance after moving to a new state is crucial for securing the right coverage at the best rates. By following the Artikeld steps and timelines, you can confidently navigate this process and ensure your peace of mind on the road ahead.

Quick FAQs

When should I start shopping for car insurance after moving to a new state?

You should start shopping for car insurance as soon as you establish residency in the new state to ensure continuous coverage.

How can I find local insurance agents or branches in the new state?

You can search online, ask for recommendations from locals, or contact insurance companies directly to inquire about local assistance.

What are some common discounts offered by insurance companies for new residents?

Common discounts include multi-policy discounts, good driver discounts, and discounts for safety features on your vehicle.

Are there grace periods for updating insurance after moving to a new state?

Grace periods vary by state and insurer, so it's important to check with your insurance provider to understand the specific timelines.